Winners & News

Search for press releases by year via the drop down menu below, or by keyword. Click "search" and view results below.

![]()

Winners & News

Results

Virginia Lottery releases May casino activity report

Jun 14, 2023 — ,

Today, the Virginia Lottery released its report on casino gaming activity for the month of May 2023. In addition to HR Bristol and Rivers Casino Portsmouth, gaming activity also includes a partial month for Virginia’s newest casino, Caesars Virginia.

Today, the Virginia Lottery released its report on casino gaming activity for the month of May 2023. In addition to HR Bristol and Rivers Casino Portsmouth, gaming activity also includes a partial month for Virginia’s newest casino, Caesars Virginia.During May, gaming revenues from Virginia casinos totaled $45.5 million. Virginia law assesses a graduated tax on a casino’s AGR, or wagers minus winnings, and $8.2 million in taxes were paid to the Gaming Proceeds Fund.

The Virginia Lottery Board approved the casino license for HR Bristol in April 2022, and the temporary facility on the site of the former Bristol Mall opened to the public on July 8, 2022. The Virginia Lottery Board approved the casino license for Rivers Casino Portsmouth in November 2022 and the casino opened to the public on January 23, 2023. The Virginia Lottery Board approved the casino license for Caesars Virginia in April 2023 and the temporary facility in Danville opened to the public on May 15, 2023.

|

May-23 |

HR Bristol |

Rivers Casino Portsmouth |

Caesars Virginia |

Total |

|||

|

Count |

AGR |

Count |

AGR |

Count |

AGR |

Adjusted Gaming Revenue |

|

|

Slots |

921 |

$11,009,426.44 |

1416 |

$13,865,117.85 |

768 |

$10,196,090.20 |

$35,070,634.49 |

|

Table Games |

29 |

$1,916,663.25 |

81 |

$6,755,234.05 |

25 |

$1,729,271.50 |

$10,401,168.80 |

|

Total |

950 |

$12,926,089.69 |

1497 |

$20,620,351.90 |

793 |

$11,925,361.70 |

$45,471,803.29 |

Of the state tax on casino AGR, the statute specifies distributions to the Problem Gambling Treatment and Support Fund, the Family and Children’s Trust Fund, and the host city. For the Bristol casino, statute specifies the portion of taxes reserved for the host city go to the Regional Improvement Commission (RIC). The timing of the tax distributions varies, but the allocation of the monthly taxes from the casino activity is as follows:

|

HR Bristol |

Rivers Casino Portsmouth |

Caesars Virginia |

Monthly Total |

|

|

Total Tax |

$2,326,696.14 |

$3,711,663.34 |

$2,146,565.11 |

$8,184,924.59 |

|

Host City / RIC (6% of AGR) |

$775,565.38 |

$1,237,221.11 |

$ 715,521.70 |

$2,728,308.19 |

|

Problem Gambling Treatment and Support Fund (0.8% of total tax) |

$18,613.57 |

$29,693.31 |

$ 17,172.52 |

$65,479.40 |

|

Family and Children’s Trust Fund (0.2% of total tax) |

$4,653.39 |

$ 7,423.33 |

$ 4,293.13 |

$16,369.85 |

|

Remaining available in the Gaming Proceeds Fund |

$1,527,863.80 |

$2,437,325.59 |

$1,409,577.76 |

$5,374,767.15 |

About Virginia Lottery

The Virginia Lottery assumed regulatory oversight of casino gaming in the Commonwealth in 2020. Taxes generated by casino gaming will benefit priorities as determined by the General Assembly. Information about casinos, including regulations and approvals, can be viewed at www.vagamingregulations.com.

York County Student Named Winner of the Virginia Lottery Thank a Teacher Art Contest

Mar 28, 2025 — ,

The Virginia Lottery is preparing to thank teachers in an artistic way, thanks to some talented young artists. A York County student was honored today as one of three winners of the eighth annual Virginia Lottery Thank a Teacher Art Contest. Allie Beatley, a ninth grader at Grafton High School, won in the contest’s high school category.

The Virginia Lottery is preparing to thank teachers in an artistic way, thanks to some talented young artists. A York County student was honored today as one of three winners of the eighth annual Virginia Lottery Thank a Teacher Art Contest. Allie Beatley, a ninth grader at Grafton High School, won in the contest’s high school category. After receiving nearly 600 entries, the Virginia Lottery selected three winners from the elementary, middle and high school levels to have their artwork featured on thank-you notes that will be distributed to thousands of teachers across the Commonwealth during National Teacher Appreciation Week (May 5 – 9, 2025). Thank a Teacher is a statewide campaign organized by the Virginia Lottery in partnership with The Supply Room, IGT, and NeoPollard Interactive. Over the years, through this campaign, Virginians have sent more than 400,000 thank-you notes, and 16 deserving teachers have been awarded fabulous prizes from the Lottery and its partners.

In a surprise presentation today, Allie was awarded a $200 gift card, and the school received a $2,000 credit from The Supply Room for its art department.

Amazingly, this is the second time Allie has won a statewide award in the Thank a Teacher Art Contest. In 2023, she won in the middle school category when she was a seventh grader at Grafton Middle School.

“The Lottery is proud to be in York today to recognize Allie’s creativity and talent,” said Virginia Lottery Executive Director Khalid Jones. “Her art will be used to thank thousands of public school teachers throughout Virginia this Teacher Appreciation Week. Teachers and students are at the core of the Lottery’s role to support K-12 public education, and the Art Contest is a unique opportunity to recognize them by giving back to the winning schools art departments, thanks to our partners at The Supply Room.”

The Thank a Teacher Art Contest winners were selected by a blue-ribbon panel of judges, including representatives of Virginia’s arts community and contest partners. When judging, the panel only knows the school level and the grade of the student, not the student’s name or school. This year’s judges were:

• Peggy Wood, executive secretary, Virginia Art Education Association

• Gina Patterson, executive director, Virginia School Board Association

• Wade Whitehead, 2011 Virginia Lottery Super Teacher (executive director, Teachers of Promise Institute, & Roanoke County teacher)

York County received nearly $5.6 million in Lottery funds for K-12 education last fiscal year. For more information and a complete list of Lottery funds to Virginia school districts, click here.

To learn more about the complete list of Thank a Teacher Art Contest winners, visit the Winners & News section of the Virginia Lottery website to stay updated as the elementary, middle and high school winners are announced.

All Virginia Lottery profits go to K-12 education in Virginia. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget. For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Florida man buys a Virginia Lottery ticket in Wise County and wins $5 million prize

Mar 28, 2025 — $5,000,000 — Big Stone Gap, VA

When Andrew Lubbers scratched his $326,000,000 Fortune ticket from the Virginia Lottery, he says he knew right away that he’d won the game’s top prize.

When Andrew Lubbers scratched his $326,000,000 Fortune ticket from the Virginia Lottery, he says he knew right away that he’d won the game’s top prize. The Palm Coast, Florida, man bought the winning ticket at the Food City at 603 Wood Avenue in Big Stone Gap, Virginia.

Mr. Lubbers had the choice of taking the full $5 million prize in annual payments over 30 years or a one-time cash option of $3,125,000 before taxes. He chose the cash option.

In addition, the store receives a $10,000 bonus from the Virginia Lottery for selling the winning ticket.

This is the third and final top prize won in the $326,000,000 Fortune game (game #2150), which means the game is now closed. It is the Virginia Lottery’s policy to end games after the final top prize is claimed.

The chances of winning the top prize in this game were 1 in 2,774,400. The chances of winning any prize in this game are 1 in 3.43.

All Virginia Lottery profits go to K-12 education in Virginia. The winning ticket was bought in Wise County, which received nearly $7.8 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Suffolk engineer wins $1 million prize in 20X the Money game

Mar 28, 2025 — Suffolk, VA

“It’s just so surreal and just such a shocking moment!”

“It’s just so surreal and just such a shocking moment!”That’s how Lisa Mojica described her feelings as she redeemed her 20X the Money ticket from the Virginia Lottery for the $1 million top prize.

The Suffolk woman bought her ticket at Dollar Delites, located at 6550 Hampton Roads Parkway in Suffolk.

She had the choice of taking the full $1 million prize over 30 years or a one-time cash option of $625,000 before taxes. She chose the annuity. She’s not the only winner. Stores that sell a $1 million winning ticket receive a $10,000 bonus from the Virginia Lottery.

Ms. Mojica, who is an engineer, said he has no immediate plans for her winnings.

This is the sixth top prize claimed in 20X the Money (game #2147), which means the game is closed. It is the Virginia Lottery’s policy to end games after the final top prize is claimed. The chances of winning the top prize in this game were 1 in 1,958,400, while the chances of winning any prize were 1 in 3.65.

All Virginia Lottery profits go to K-12 education in Virginia. Ms. Mojica lives in Suffolk, which received more than $12 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

North Carolina man wins $1,000,000 Virginia Lottery prize in Danville

Mar 28, 2025 — $1,000,000 — Danville, VA

Edward Daye had driven from his home in Greensboro, North Carolina, to Danville. While he was there, he decided to buy a Virginia Lottery ticket. Turns out, that ticket was a $1 million winner.

Edward Daye had driven from his home in Greensboro, North Carolina, to Danville. While he was there, he decided to buy a Virginia Lottery ticket. Turns out, that ticket was a $1 million winner.When he got home and scratched the ticket, he scanned it on the Virginia Lottery’s mobile app, and it showed up as a big winner.

“What in the world? No way is this possible!” was his reaction.

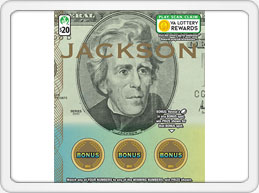

Mr. Daye won the top prize in the Jackson scratcher game. He bought his winning ticket at Carter’s Quick Shoppe at 3103 West Main Street in Danville.

Jackson is one of dozens of scratcher games available from the Virginia Lottery. It features prizes ranging from $20 up to that $1 million top prize. This is the first top prize claimed in this game, which means two more remain unclaimed.

The odds of winning the top prize in the Jackson game are 1 in 408,000. The odds of winning any prize in this game are 1 in 2.8.

All Virginia Lottery profits go to K-12 education in Virginia. Mr. Daye bought the ticket in Danville, which received more than $11 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Charlottesville man scratches to win $500,000 Virginia Lottery prize

Mar 28, 2025 — $500,000 — Charlottesville, VA

It’s usually not a good thing when you hear your coworker scream. However, in Robert Green’s case, it was great!

It’s usually not a good thing when you hear your coworker scream. However, in Robert Green’s case, it was great!The Charlottesville man had bought and scratched a Hamilton ticket from the Virginia Lottery. He handed the ticket to his coworker while he continued his work. That’s when the coworker screamed, having discovered the ticket was a $500,000 top prize winner.

Mr. Green bought his winning ticket at Lucky Seven, located at 801 East Market Street in Charlottesville.

Hamilton is one of dozens of scratcher games available from the Virginia Lottery. It features prizes ranging from $10 up to that $500,000 top prize. The odds of winning the top prize in the Hamilton game are 1 in 612,000. The odds of winning any prize in this game are 1 in 3.77.

All Virginia Lottery profits go to K-12 education in Virginia. Mr. Green lives in Charlottesville, which received more than $2.6 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Lynchburg bartender serves up $270,000 Lottery win

Mar 28, 2025 — $270,912 — Lynchburg, VA

Charles Hodnett was just hanging out with some friends watching TV when he started playing a Virginia Lottery online game on his phone. He had recently installed the Virginia Lottery’s mobile app and was still getting used to it.

Charles Hodnett was just hanging out with some friends watching TV when he started playing a Virginia Lottery online game on his phone. He had recently installed the Virginia Lottery’s mobile app and was still getting used to it.It didn’t take him long to win a $270,912 jackpot in the Luminous Loot game.

“I was really surprised!” the Lynchburg man later told Lottery officials. “It still hasn’t hit me yet!”

Luminous Loot is one of dozens of online games offered by the Virginia Lottery. The odds per game of winning a prize are 1 in 3.95.

In addition to online instant games, Virginia Lottery players can purchase Powerball, Mega Millions, Cash4Life, Pick 3, Pick 4, Pick 5 and Cash 5 with EZ Match plays online. Players need to be at least 18 years of age and physically located in Virginia.

Mr. Hodnett, who is a bartender, said he has no immediate plans for his winnings.

“It feels like a dream!” he told Lottery officials.

All Virginia Lottery profits go to K-12 education in Virginia. Mr. Hodnett lives in Lynchburg, which received more than $11.1 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Radford City Student Named Winner of the Virginia Lottery Thank a Teacher Art Contest

Mar 27, 2025 — ,

The Virginia Lottery is preparing to thank teachers in an artistic way, thanks to some talented young artists. A Radford City student is being honored as one of three winners of the eighth annual Virginia Lottery Thank a Teacher Art Contest. Avalyn Church, a fifth grader at Belle Heth Elementary School, won in the contest’s elementary school category.

The Virginia Lottery is preparing to thank teachers in an artistic way, thanks to some talented young artists. A Radford City student is being honored as one of three winners of the eighth annual Virginia Lottery Thank a Teacher Art Contest. Avalyn Church, a fifth grader at Belle Heth Elementary School, won in the contest’s elementary school category. After receiving nearly 600 entries, the Virginia Lottery selected three winners from the elementary, middle and high school levels to have their artwork featured on thank-you notes that will be distributed to thousands of teachers across the Commonwealth during National Teacher Appreciation Week (May 5 – 9, 2025). Thank a Teacher is a statewide campaign organized by the Virginia Lottery in partnership with The Supply Room, IGT, and NeoPollard Interactive. Over the years, through this campaign, Virginians have sent more than 400,000 thank-you notes, and 16 deserving teachers have been awarded fabulous prizes from the Lottery and its partners.

In a surprise presentation, Avalyn was awarded a $200 gift card, and the school received a $2,000 credit from The Supply Room for its art department.

“The Lottery is proud to be in Radford to recognize Avalyn’s creativity and talent,” said Virginia Lottery Executive Director Khalid Jones. “Her art will be used to thank thousands of public school teachers throughout Virginia this Teacher Appreciation Week. Teachers and students are at the core of the Lottery’s role to support K-12 public education, and the Art Contest is a unique opportunity to recognize them by giving back to the winning schools art departments, thanks to our partners at The Supply Room.”

The Thank a Teacher Art Contest winners were selected by a blue-ribbon panel of judges, including representatives of Virginia’s arts community and contest partners. The judges were:

• Peggy Wood, executive secretary, Virginia Art Education Association

• Gina Patterson, executive director, Virginia School Board Association

• Wade Whitehead, 2011 Virginia Lottery Super Teacher (executive director, Teachers of Promise Institute, & Roanoke County teacher)

Radford City received nearly $2.5 million in Lottery funds for K-12 education last fiscal year. For more information and a complete list of Lottery funds to Virginia school districts, click here.

To learn more about the complete list of Thank a Teacher Art Contest winners, visit the Winners & News section of the Virginia Lottery website to stay updated as the elementary, middle and high school winners are announced.

All Virginia Lottery profits go to K-12 education in Virginia. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget. For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

New Mega Millions® coming to Virginia with bigger prizes, better jackpot odds, bigger starting jackpot and more. First drawing set for Tuesday, April 8.

Mar 26, 2025 — ,

Lottery players in Virginia will get to experience the new version of Mega Millions®, following the final drawing of the current game on Friday, April 4. The game now will feature larger starting jackpots and bigger prizes at every non-jackpot prize tier with a built-in multiplier feature. The first drawing under the new prize structure will be held Tuesday, April 8, at 11 p.m. The cost of single play ticket will increase from $2 to $5.

Lottery players in Virginia will get to experience the new version of Mega Millions®, following the final drawing of the current game on Friday, April 4. The game now will feature larger starting jackpots and bigger prizes at every non-jackpot prize tier with a built-in multiplier feature. The first drawing under the new prize structure will be held Tuesday, April 8, at 11 p.m. The cost of single play ticket will increase from $2 to $5. “Virginians have supported the Mega Millions game since we were one of the game’s founding states in 2002,” said Virginia Lottery Executive Director Khalid Jones. “We think our players will be excited by a new and improved version the game. Virginia has had nine Mega Millions jackpot wins over the years and hopefully will have more in the future. Of course, as with all our games, the profit from the sale of each ticket goes to support our K-12 public schools.”

A full prize matrix is available here on the Virginia Lottery website. Other game enhancements include:

• Improved odds to win the jackpot – Odds to win the jackpot will improve to 1 in 290,472,336 from 1 in 302,575,350.

• Improved overall odds – Overall odds to win any prize will improve to 1 in 23 from 1 in 24.

• Larger starting jackpots – Following a jackpot win, the starting jackpot will reset to $50 million instead of the current $20 million.

• Faster-growing jackpots and bigger jackpots more frequently – Jackpots are expected to grow faster and reach higher dollar amounts more frequently.

• Win more than the cost to play – With a minimum prize of $10 on a winning ticket in the new game, every winning ticket will pay out more than the $5 cost for each play. In the current game, the minimum prize on a winning ticket and cost to play are the same: $2.

The price increase to $5 is only the game’s second price adjustment in the game’s history and the first change since the current game matrix was adopted in 2017.

Since Mega Millions launched in 2002, it has produced seven winners of billion-dollar jackpots, all in different states. Since the last change in 2017 more than 1,200 players have become millionaires, an average of three millionaires per week.

Mega Millions is played in 45 states, plus Washington, D.C. and the U.S. Virgin Islands. Drawings are held Tuesday and Friday nights at 11 p.m.

All Virginia Lottery profits go to K-12 education in Virginia. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, X, Instagram, or YouTube.

With all gaming, please play responsibly.

Norfolk woman wins more than $380,000 in Cash 5 with EZ Match drawing

Mar 25, 2025 — $383,307 — Norfolk, VA

“I didn’t get excited because I didn’t know if it was really true.”

“I didn’t get excited because I didn’t know if it was really true.”That was Geraldine Davis-Hines’ reaction when she received a series of emails from the Virginia Lottery saying she had matched all five numbers in the February 28 Cash 5 with EZ Match drawing.

She received the emails because she bought her ticket online from the Virginia Lottery. Players can purchase tickets through either the Virginia Lottery app or on the Lottery’s website, valottery.com.

It really was true! By matching all the winning numbers, the Norfolk woman won the $383,307 jackpot.

The winning numbers for that drawing were 9-17-32-40-45. She selected the numbers on her ticket at random.

The Virginia Lottery gives players the opportunity to play popular games, such as Powerball, Mega Millions, Cash4Life, Pick 3, Pick 4, Pick 5 and Cash 5 with EZ Match, online. Players must be at least 18 years of age and physically located in Virginia.

Cash 5 with EZ Match features a rolling jackpot starting at a minimum of $200,000. The odds of matching all five numbers to win the jackpot are 1 in 1,221,759.

All Virginia Lottery profits go to K-12 education in Virginia. Ms. Davis-Hines lives in Norfolk, which received more than $36.5 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Virginia Beach man wins more than $540,000 just “goofing around”

Mar 25, 2025 — $541,440 — Virginia Beach, VA

Brian Cullen said he was just “goofing around” with the Virginia Lottery’s The Lamp online game when he happened to win a jackpot worth $541,440.

Brian Cullen said he was just “goofing around” with the Virginia Lottery’s The Lamp online game when he happened to win a jackpot worth $541,440.“I had to jump up!” the Virginia Beach man told Lottery officials.

The Lamp is one of dozens of online games available on the Virginia Lottery’s mobile app and at valottery.com. It features a progressive, growing jackpot. The odds per game of winning a prize are 1 in 3.55.

In addition to online instant games, players can purchase Powerball, Mega Millions, Cash4Life, Pick 3, Pick 4, Pick 5 and Cash 5 with EZ Match plays online. Players must be at least 18 years of age and physically located in Virginia.

Mr. Cullen said he was already planning to retire in the near future, so the win will help.

“It really feels good!” he said.

All Virginia Lottery profits go to K-12 education in Virginia. Mr. Cullen lives in Virginia Beach, which received more than $39.7 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

James City County neighbors split $3 million Mega Millions prize

Mar 20, 2025 — $3,000,000 — James City County, VA

Thomas Bell and Lorraine Dimuccio have been neighbors for twenty-some years. One afternoon, they saw each other at a happy hour and got to talking. They decided to go in together and play Mega Millions. The ticket that Thomas bought ended up winning $3 million.

Thomas Bell and Lorraine Dimuccio have been neighbors for twenty-some years. One afternoon, they saw each other at a happy hour and got to talking. They decided to go in together and play Mega Millions. The ticket that Thomas bought ended up winning $3 million.“I couldn’t believe it!” Lorraine later told Virginia Lottery officials.

“I was stunned!” Thomas added.

The ticket was bought at the 7-Eleven at 1800 Jamestown Road in James City County. It matched the first five numbers in the March 7 drawing, missing only the Mega Ball number. Normally, that would win $1 million. However, they spent an extra dollar for the Megaplier when they bought the ticket, which tripled the prize to $3 million.

The winning numbers were 8-20-48-58-60, and the Mega Ball number was 7. This was the only ticket in Virginia to match the first five numbers in that drawing and one of only two nationwide. Had the ticket matched all six numbers, it would have won a jackpot worth an estimated $233 million.

Mega Millions drawings are held Tuesday and Friday nights at 11 p.m. The odds of matching the first five numbers in Mega Millions are 1 in 12,607,306. The odds of matching all six numbers to win the jackpot are 1 in 302,575,350.

All Virginia Lottery profits go to K-12 education in Virginia. James City County received more than $4.8 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Stafford County woman gallops to $3 million Lottery win

Mar 19, 2025 — $3,046,100 — Stafford, VA

Amy Sylvester was feeding the horses at her barn. As she waited for them to finish, she pulled out her phone and started playing the Virginia Lottery’s Jackpot Spectacular online game. Before long, the Fredericksburg-area woman had won a jackpot worth $3,046,100.

Amy Sylvester was feeding the horses at her barn. As she waited for them to finish, she pulled out her phone and started playing the Virginia Lottery’s Jackpot Spectacular online game. Before long, the Fredericksburg-area woman had won a jackpot worth $3,046,100.“I was surprised!” she told Lottery officials. “I didn’t think it was real!”

Jackpot Spectacular is a progressive jackpot game played in multiple states, including Virginia. It’s one of dozens of online games offered by the Virginia Lottery. The odds per game of winning a prize are 1 in 3.99.

In addition to online instant games, Virginia Lottery players can purchase Powerball, Mega Millions, Cash4Life, Pick 3, Pick 4, Pick 5 and Cash 5 with EZ Match plays online. Players need to be at least 18 years of age and physically located in Virginia.

All Virginia Lottery profits go to K-12 education in Virginia. Ms. Sylvester lives in Stafford County, which received more than $18.4 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Mechanicsville man wins more than $785,000 playing online Virginia Lottery game

Mar 19, 2025 — $787,893 — Mechanicsville, VA

Javon Robinson was relaxing after doing some yardwork. He saw a new online game from the Virginia Lottery and decided to give it a try.

Javon Robinson was relaxing after doing some yardwork. He saw a new online game from the Virginia Lottery and decided to give it a try. The Mechanicsville man soon won a jackpot worth $787,893.

“I immediately called my wife and said, ‘Look at this!’” he later told Lottery officials.

“Is this real?” she asked.

“I think it is!” was his reply.

He was right. He had just won big playing Spellbound, one of dozens of online games offered by the Virginia Lottery. The odds per game of winning a prize are 1 in 3.91.

In addition to online instant games, Virginia Lottery players can purchase Powerball, Mega Millions, Cash4Life, Pick 3, Pick 4, Pick 5 and Cash 5 with EZ Match plays online. Players need to be at least 18 years of age and physically located in Virginia.

Mr. Robinson said he has no immediate plans for his winnings except to pay bills.

“It was a surreal and insane moment!” he said.

All Virginia Lottery profits go to K-12 education in Virginia. Mr. Robinson lives in Hanover County, which received more than $7.2 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Front Royal man wins $250,000 in Virginia Lottery scratcher game

Mar 19, 2025 — $250,000 — Front Royal, VA

Paul Rush needed some new tires for his vehicle. So after the Front Royal man had the tires put on, he stopped by a nearby store and picked up some Virginia Lottery scratcher tickets.

Paul Rush needed some new tires for his vehicle. So after the Front Royal man had the tires put on, he stopped by a nearby store and picked up some Virginia Lottery scratcher tickets.That turned out to be a $250,000 decision.

One of his tickets he bought at Royal Gas Station on West 14th Street in Front Royal ended up winning the game’s top prize.

“I was really happy!” he told Virginia Lottery officials as he redeemed his winning ticket.

The game was Black Diamond Dazzler, one of dozens of scratcher games offered by the Virginia Lottery. It features prizes ranging from $5 up to that $250,000 top prize. This is the first top prize claimed in the game, which means two more top prizes are unclaimed. The chances of winning the top prize are 1 in 1,020,000. The chances of winning any prize in this game are 1 in 4.68.

All Virginia Lottery profits go to K-12 education in Virginia. Mr. Rush lives in Warren County, which received more than $3.7 million in Lottery funds for K-12 education last fiscal year. In Fiscal Year 2024, the Lottery raised more than $934 million for K-12 education, making up approximately 10 percent of Virginia’s total K-12 school budget.

For a complete list of Lottery funds distributed to Virginia school districts, visit the Virginia Lottery’s Giving Back page. For general information or to play games online, visit the Virginia Lottery’s website or download the Lottery’s app. Connect with the Lottery on Facebook, Twitter, Instagram, or YouTube.

With all gaming, please play responsibly.

Virginia Lottery releases February casino activity report

Mar 14, 2025 — ,

Today, the Virginia Lottery released its report on casino gaming activity for the month of February 2025. There are three operating casinos in Virginia: Hard Rock Bristol, Rivers Casino Portsmouth, and Caesars Virginia.

Today, the Virginia Lottery released its report on casino gaming activity for the month of February 2025. There are three operating casinos in Virginia: Hard Rock Bristol, Rivers Casino Portsmouth, and Caesars Virginia.During February, gaming revenues from Virginia casinos totaled $75.2 million. Virginia law assesses a graduated tax on a casino’s AGR, or wagers minus winnings, and $13.5 million in taxes were paid to the Gaming Proceeds Fund.

|

Feb-25 |

Hard Rock Bristol |

Rivers Casino Portsmouth |

Caesars Virginia |

Total |

|||

|

Count |

AGR |

Count |

AGR |

Count |

AGR |

Adjusted Gaming Revenue |

|

|

Slots |

1484 |

$16,431,393.80 |

1417 |

$17,459,539.90 |

1477 |

$21,540,403.85 |

$55,431,337.55 |

|

Table Games |

73 |

$3,318,315.25 |

84 |

$6,821,310.35 |

100 |

$9,601,763.75 |

$19,741,389.35 |

|

Total |

1557 |

$19,749,709.05 |

1501 |

$24,280,850.25 |

1577 |

$31,142,167.60 |

$75,172,726.90 |

Of the state tax on casino AGR, the statute specifies distributions to the Problem Gambling Treatment and Support Fund, the Family and Children’s Trust Fund, and the host city. For the Bristol casino, statute specifies the portion of taxes reserved for the host city go to the Regional Improvement Commission (RIC). The timing of the tax distributions varies, but the allocation of the monthly taxes from the casino activity is as follows:

|

Hard Rock Bristol |

Rivers Casino Portsmouth |

Caesars Virginia |

Monthly Total |

|

|

Total Tax |

$3,554,947.63 |

$4,370,553.05 |

$5,605,590.17 |

$13,531,090.85 |

|

Host City / RIC (6% of AGR) |

$1,184,982.54 |

$1,456,851.02 |

$1,868,530.06 |

$4,510,363.62 |

|

Problem Gambling Treatment and Support Fund (0.8% of total tax) |

$28,439.58 |

$34,964.42 |

$44,844.72 |

$108,248.72 |

|

Family and Children’s Trust Fund (0.2% of total tax) |

$7,109.90 |

$8,741.11 |

$11,211.18 |

$27,062.19 |

|

Remaining available in the Gaming Proceeds Fund |

$2,334,415.61 |

$2,869,996.50 |

$3,681,004.21 |

$8,885,416.32 |

About Virginia Lottery

The Virginia Lottery assumed regulatory oversight of casino gaming in the Commonwealth in 2020. Taxes generated by casino gaming will benefit priorities as determined by the General Assembly. Information about casinos, including regulations and approvals, can be viewed at www.valottery.com/aboutus/casinosandsportsbetting/casinos.